Inheritance Tax

We could help you with your inheritance tax. If you’d like to learn more, then get in touch and we’ll provide you with expert advice tailored to your personal circumstances.

An introduction to Inheritance Tax (IHT)

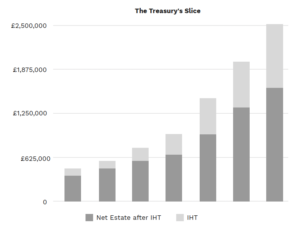

At its simplest, IHT is a 40% tax generated upon death that applies to the amount by which your estate exceeds the nil-rate band, which is currently 325,000 for the 2021/2022 tax year. Your estate will include any gifts made in the seven years preceding your death (unless the gifts are covered by exemptions). There are often other reliefs and exemptions that may help to reduce your IHT liability (we’ll cover these shortly); however, if none of these apply, your estate will be divided between IHT payable to HM Treasury and your beneficiaries, as demonstrated by this graph. This shows clearly the increasing impact of IHT at 40% as the value of the estate rises.

Opposite: Graph based on the nil-rate band of 325,000 (2021/2022 tax year)

IHT exemptions and reliefs

There are a range of exemptions and reliefs that can reduce your IHT liability.

Spouse or civil partner exemption

Any amount left to your spouse/civil partner in your Will is exempt from IHT. The same applies for lifetime gifts to your spouse/civil partner as long as they are permanent UK residents. There are no exemptions for unmarried couples or ‘common-law’ spouses.

Transferable nil-rate band

If a spouse/civil partner does not use their entire nil-rate band when they die (e.g. because their entire estate passes to their widow(er)), then the unused portion is added onto their estate when the second partner dies. According to 2021/2022 tax year rates, this means that if each spouse’s Will leaves everything to the surviving partner, then the threshold before tax becomes payable will increase to the equivalent of two nil-rate bands (i.e. a maximum of 650,000).

Residence Nil Rate Band (RNRB)

Couples with direct descendants and who have an estate (which includes their main residence) exceeding the IHT threshold may be eligible for this relief. Effectively, it introduces an additional threshold on top of the current 325,000 nil-rate band, making it easier to pass on the family home without incurring IHT. The RNRB for 2021/2022 is 175,000.

Annual exemption

In addition to being able to gift as much as you like to your spouse or civil partner, you’re also permitted to make IHT-free gifts of up to 3,000 each tax year. Even better, you can carry this exemption forward (for one tax year only) – but only after you have used the current year’s exemption. It is possible to use this exemption (including any amount carried forward) as part of a larger gift.

Charitable gifts

Any amount of money you gift to a UK-registered charity (either during your lifetime or as a bequest) is exempt from IHT. In addition, if you leave 10% or more of your taxable estate to charity, the IHT rate levied on your estate will typically be cut to 36%.

Agricultural property relief

If you own all, or part of, a trading business or farm, you may be entitled to other valuable reliefs. The rules are complex1, but in broad terms:

— Agricultural Relief is due at 100% if the landowner farmed it themselves, if the land was used by someone else on a shortterm grazing licence, or if it was let on a tenancy that began on or after 1 September 1995. Relief is due at a lower rate of 50% in most other cases.

HM Revenue and Customs practice and the law relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen.

Small gifts exemption

You can make small gifts of up to 250 to as many people as you like and these gifts will all be exempt from IHT. However, this exemption does not apply to anyone to whom you have gifted money in the current tax year using your 3,000 annual exemption.

Normal expenditure gifts exemption

If you make regular gifts out of your income that do not reduce your standard of living (e.g. regular pension contributions for family members), these will also be exempt from IHT. This can be useful if you have surplus income, whatever the source.

Taper relief

In the unusual circumstance that you make lifetime gifts that attract tax, either during your lifetime or within the seven years preceding your death, the recipient(s) may benefit from taper relief. This relief reduces the amount of tax payable when you die, if the gift was made more than three years before your death.

Wedding/civil partnership gifts

Gifts made to someone who is getting married or registering a civil partnership are exempt from IHT up to a certain threshold, which depends on your relationship to the parties. A maximum of 5,000 can be gifted by parents to their child, 2,500 by grandparents to their grandchild, and 1,000 to anyone else.

Agricultural shares and securities

Some company shares and securities are eligible for Agricultural Relief if their value:

— Gave the deceased control of the company at the time of their death and comes from agricultural property that forms part of the company’s assets.

— There are also rules relating to the sale of related property within three years of the owner’s death.

These reliefs will often allow family enterprises to be passed on completely free of IHT if the appropriate conditions are met. If you think they may be relevant, then, advice is absolutely vital to ensure you receive the relief you’re entitled to.

It pays to think carefully before choosing what to do with your inheritance.

Like all aspects of financial planning, it is sensible to speak to an expert before choosing which type of investments to commit to. We can advise on the options which may be prudent to consider.